Best Life Insurance Companies

What do you mean by Life Insurance?

Life insurance is a type of financial protection that provides a lump sum payment to your beneficiaries in the event of your death. This payment can help cover expenses such as funeral costs, mortgage payments, and other financial obligations. It is a way to ensure that your loved ones are taken care of financially after you are gone.

How does Life Insurance Work?

When you purchase a life insurance policy, you pay premiums to the insurance company in exchange for coverage. The amount of coverage and the cost of premiums will depend on factors such as your age, health, and lifestyle. If you pass away while the policy is in effect, the insurance company will pay out the death benefit to your beneficiaries.

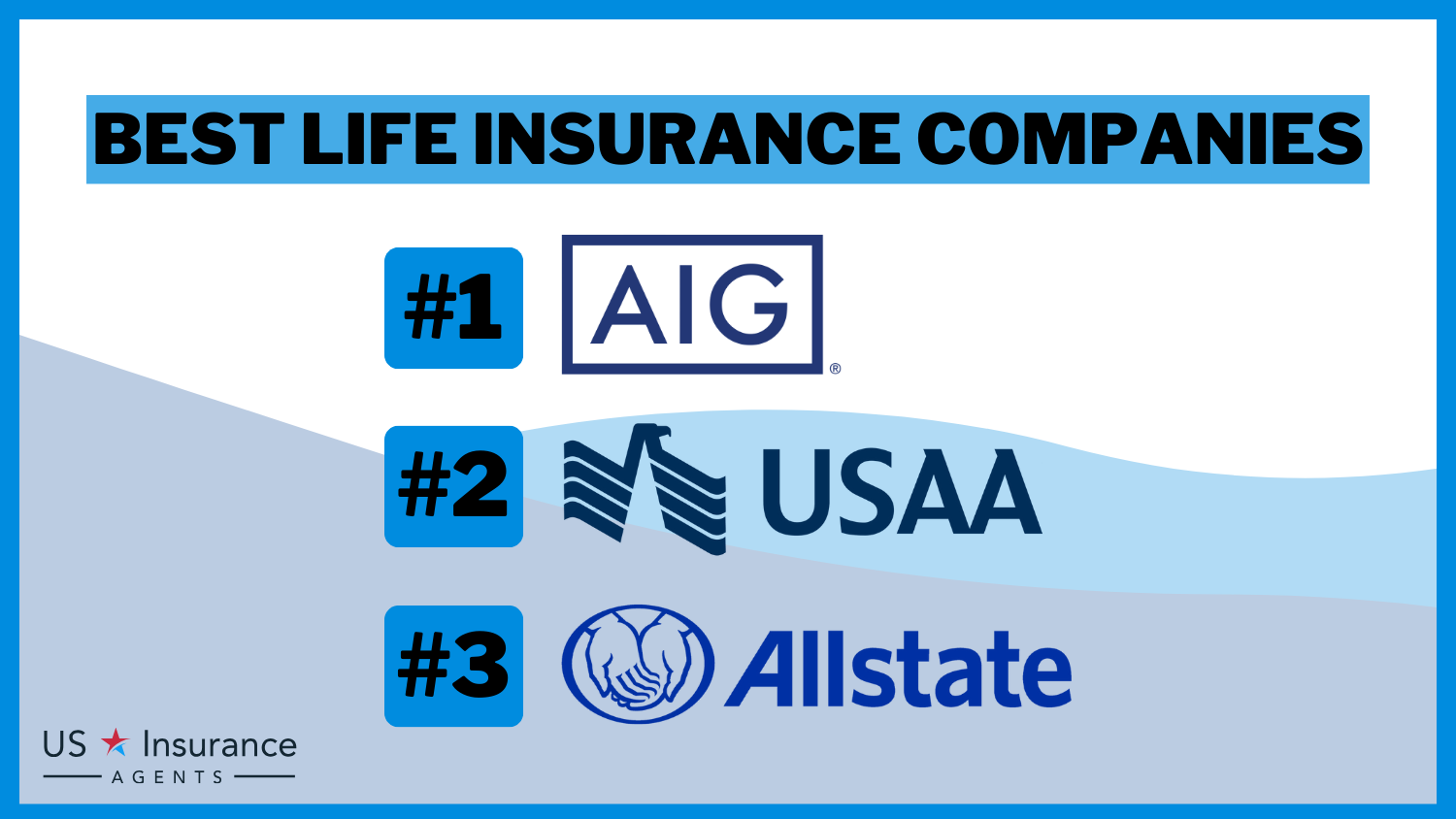

What is known about the Best Life Insurance Companies?

Image Source: usinsuranceagents.com

When it comes to choosing a life insurance company, there are several factors to consider. Some of the best life insurance companies are known for their financial strength, customer service, and variety of policy options. These companies have high ratings from independent rating agencies and a track record of paying out claims promptly.

Solution

To find the best life insurance company for your needs, it is important to compare quotes from multiple insurers and consider factors such as coverage options, customer service, and financial stability. You can also read reviews and ratings from customers to get an idea of the company’s reputation. Working with a licensed insurance agent can also help you navigate the process and find the best policy for your situation.

Information

Some of the top-rated life insurance companies in the industry include companies such as Northwestern Mutual, New York Life, and MassMutual. These companies are known for their strong financial ratings and long histories of providing reliable coverage to policyholders. Other reputable companies to consider include State Farm, Prudential, and Guardian Life.

About Northwestern Mutual

Northwestern Mutual is one of the largest and most well-respected life insurance companies in the industry. They offer a variety of policy options, including term life, whole life, and universal life insurance. Northwestern Mutual is known for its financial strength and high customer satisfaction ratings.

About New York Life

New York Life is another top-rated life insurance company that has been in business for over 175 years. They offer a range of policy options, including term, whole life, and universal life insurance. New York Life is known for its strong financial ratings and commitment to customer service.

About MassMutual

MassMutual is a mutual company that has been providing life insurance coverage for over 160 years. They offer a variety of policy options, including term, whole life, and universal life insurance. MassMutual is known for its financial stability and commitment to policyholder dividends.

Conclusion

Choosing the best life insurance company is an important decision that can provide peace of mind for you and your loved ones. By comparing quotes, researching companies, and working with a licensed insurance agent, you can find the right policy that meets your needs and fits your budget.

FAQs

1. How do I choose the best life insurance company?

To choose the best life insurance company, consider factors such as financial strength, customer service, and policy options. Compare quotes from multiple insurers and read reviews from customers to make an informed decision.

2. What types of life insurance policies are available?

There are several types of life insurance policies available, including term life, whole life, and universal life insurance. Each type of policy has its own features and benefits, so it is important to choose the right one for your needs.

3. How much life insurance coverage do I need?

The amount of life insurance coverage you need will depend on factors such as your income, expenses, and financial goals. A licensed insurance agent can help you determine the right amount of coverage for your situation.

4. Can I purchase life insurance online?

Many life insurance companies offer the option to purchase coverage online. You can compare quotes, apply for coverage, and manage your policy online with many insurers.

5. What happens if I miss a premium payment?

If you miss a premium payment on your life insurance policy, the coverage may lapse or be canceled. It is important to stay current on your payments to ensure that your policy remains in force.

Best life insurance companies