Real Estate Mortgage Rates: Everything You Need to Know

What do you mean by Real Estate Mortgage Rates?

Real estate mortgage rates refer to the interest rate that is charged on a loan used to purchase a home or other real estate property. These rates can vary based on a number of factors, including the borrower’s credit score, the size of the loan, and the overall health of the economy. Mortgage rates can have a significant impact on the overall cost of purchasing a home, so it’s important for prospective buyers to understand how they work.

How do Real Estate Mortgage Rates work?

When a borrower takes out a mortgage loan to purchase a home, they are required to pay back the loan amount plus interest over a set period of time. The interest rate on the loan is determined by the lender and is based on a number of factors, including the current market conditions and the borrower’s creditworthiness. The higher the interest rate, the more the borrower will have to pay in interest over the life of the loan.

What is known about Real Estate Mortgage Rates?

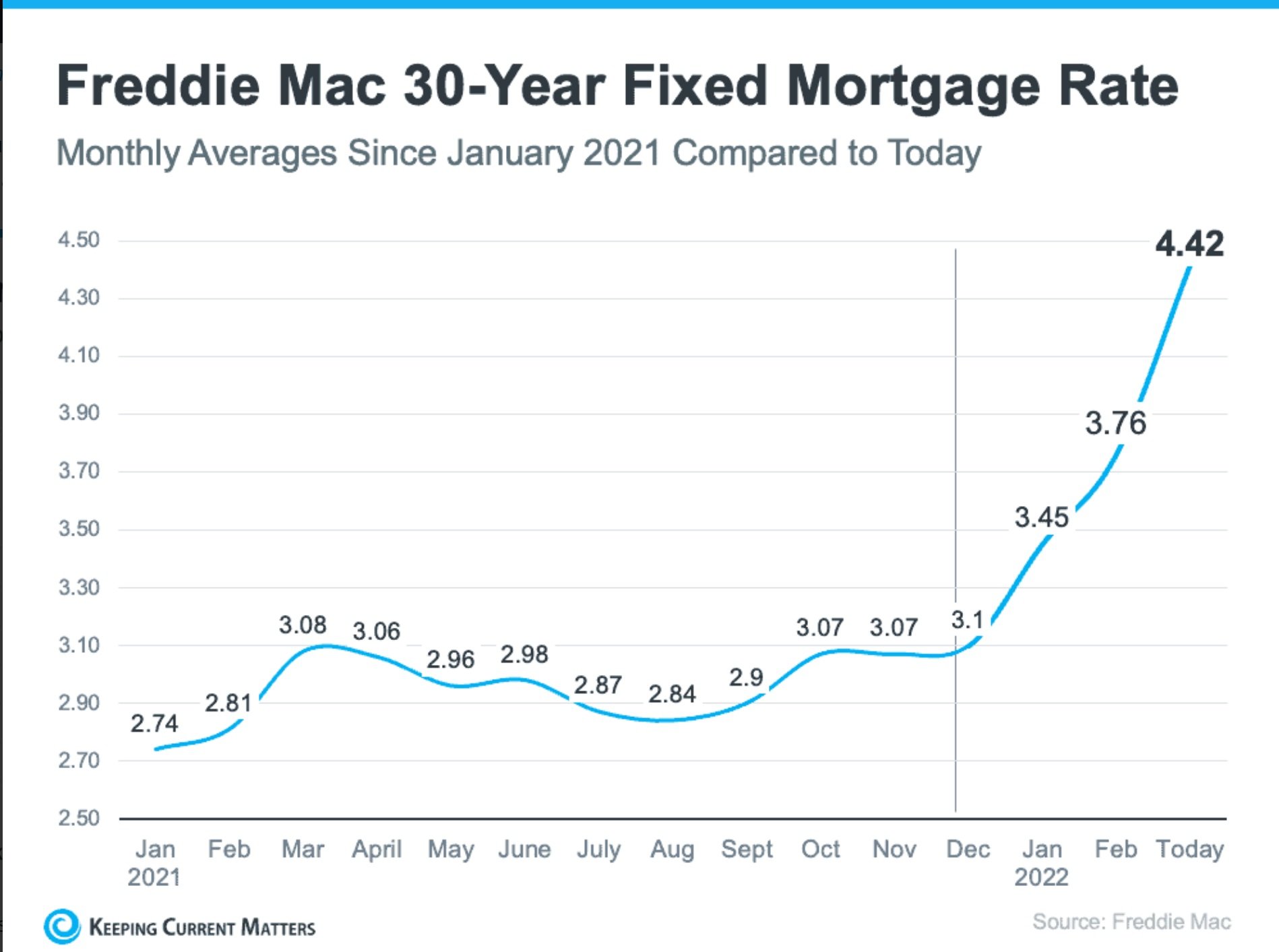

Image Source: squarespace-cdn.com

Real estate mortgage rates are influenced by a variety of factors, including the Federal Reserve’s monetary policy, inflation rates, and the overall health of the housing market. When the economy is strong, mortgage rates tend to rise as lenders seek to maximize their profits. Conversely, when the economy is weak, mortgage rates may fall in an effort to stimulate borrowing and home buying.

What is the solution to managing Real Estate Mortgage Rates?

There are a few strategies that prospective home buyers can use to manage real estate mortgage rates. One option is to shop around for the best rate by comparing offers from multiple lenders. It’s also important to maintain a strong credit score, as borrowers with higher credit scores typically qualify for lower interest rates. Finally, buyers can consider locking in a rate with a lender to ensure that they are protected from any potential rate increases during the home buying process.

Information on Real Estate Mortgage Rates

Real estate mortgage rates are typically expressed as an annual percentage rate (APR), which includes not only the interest rate but also any additional fees and charges associated with the loan. It’s important for borrowers to carefully review the terms of their mortgage loan agreement to understand the total cost of borrowing. Additionally, mortgage rates can fluctuate daily based on market conditions, so it’s important to stay informed and keep an eye on rate trends.

Conclusion

Real estate mortgage rates play a crucial role in the home buying process, impacting the overall affordability of a property. By understanding how mortgage rates work and taking steps to manage them effectively, prospective buyers can make informed decisions that align with their financial goals. Whether you’re a first-time home buyer or a seasoned investor, staying informed about mortgage rates can help you secure the best possible loan terms for your real estate purchase.

FAQs

1. What factors influence real estate mortgage rates?

Real estate mortgage rates are influenced by factors such as the Federal Reserve’s monetary policy, inflation rates, and the overall health of the housing market.

2. How can I get the best mortgage rate?

To get the best mortgage rate, it’s important to shop around, maintain a strong credit score, and consider locking in a rate with a lender.

3. How often do real estate mortgage rates change?

Real estate mortgage rates can fluctuate daily based on market conditions, so it’s important to stay informed and keep an eye on rate trends.

4. Is it possible to negotiate mortgage rates?

While some lenders may be open to negotiation, mortgage rates are typically set based on market conditions and the borrower’s creditworthiness.

5. What should I do if mortgage rates rise?

If mortgage rates rise, borrowers can consider refinancing their loan or exploring other financing options to mitigate the impact of higher rates on their monthly payments.

Real estate mortgage rates