Insurance Quotes Comparison: Everything You Need to Know

What do you mean by Insurance Quotes Comparison?

Insurance quotes comparison refers to the process of comparing insurance quotes from different insurance providers to find the best coverage and rates for your needs. This can be done for various types of insurance, such as auto, home, health, and life insurance. By comparing quotes, you can ensure that you are getting the best value for your money and the coverage that meets your specific needs.

How to Compare Insurance Quotes?

There are several ways to compare insurance quotes. One common method is to use online comparison tools that allow you to input your information and receive quotes from multiple insurance companies. You can also contact insurance agents directly to request quotes or use comparison websites to see side-by-side comparisons of different policies.

What is known about the Importance of Insurance Quotes Comparison?

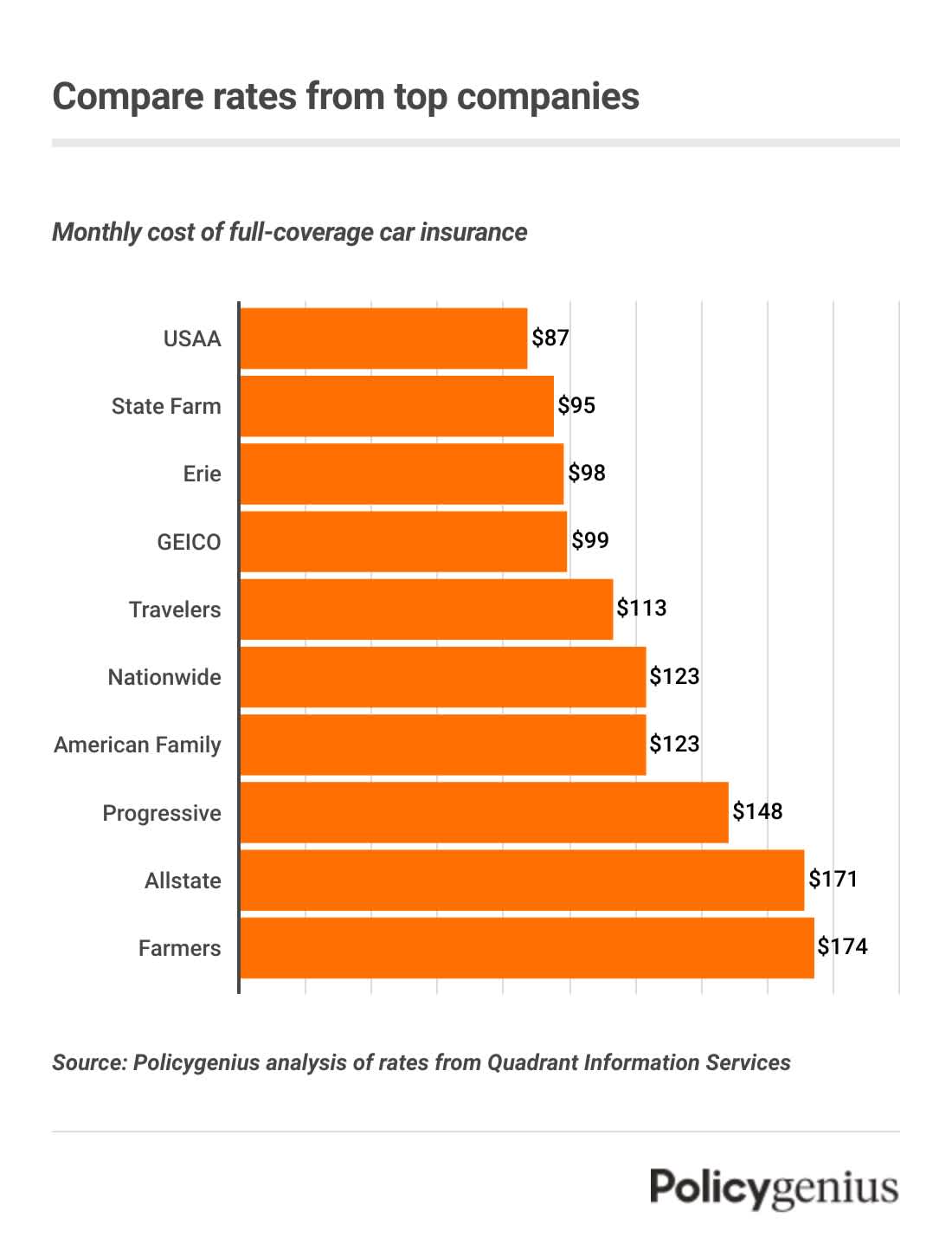

Comparing insurance quotes is important because it can help you save money and ensure that you are getting the best coverage for your needs. Insurance rates can vary significantly between providers, so taking the time to compare quotes can result in substantial savings. Additionally, comparing quotes can help you understand the different types of coverage available and make an informed decision about which policy is right for you.

What is the Solution?

The solution to finding the best insurance coverage at the most affordable rates is to compare insurance quotes from multiple providers. By taking the time to compare quotes, you can ensure that you are getting the best value for your money and the coverage that meets your specific needs. It is important to consider factors such as coverage limits, deductibles, and exclusions when comparing quotes to ensure that you are getting the coverage you need.

Information about Insurance Quotes Comparison

When comparing insurance quotes, it is important to provide accurate information about yourself and your insurance needs. This information may include your age, location, driving record, health history, and the type of coverage you are looking for. By providing accurate information, you can ensure that the quotes you receive are tailored to your specific needs and will accurately reflect the cost of coverage.

Image Source: ctfassets.net

It is also important to consider the reputation and financial stability of the insurance companies you are comparing. Look for companies with a strong track record of customer satisfaction and a good reputation for paying claims. Additionally, consider the financial strength of the company as this can affect its ability to pay claims in the future.

When comparing insurance quotes, it is important to carefully review the coverage options and exclusions. Make sure you understand what is covered under each policy and what is not. Pay attention to details such as coverage limits, deductibles, and co-pays to ensure that you are getting the coverage you need at a price you can afford.

Finally, when comparing insurance quotes, consider the level of customer service offered by each insurance provider. Look for companies that are responsive to customer inquiries and have a reputation for providing excellent service. A company that is easy to reach and willing to answer your questions can provide peace of mind knowing that you will be well taken care of in the event of a claim.

Conclusion

In conclusion, insurance quotes comparison is an essential step in finding the best insurance coverage at the most affordable rates. By comparing quotes from multiple providers, you can ensure that you are getting the coverage you need at a price you can afford. Take the time to review the coverage options, exclusions, and customer service offered by each insurance provider to make an informed decision about which policy is right for you.

FAQs

1. How often should I compare insurance quotes?

It is recommended to compare insurance quotes at least once a year to ensure you are getting the best coverage at the most affordable rates.

2. Can I switch insurance providers if I find a better quote?

Yes, you can switch insurance providers at any time if you find a better quote that meets your needs. Be sure to review the terms of your current policy before switching to avoid any penalties or fees.

3. Are online comparison tools safe to use?

Yes, online comparison tools are safe to use as long as you provide accurate information and use reputable websites. Be cautious of any sites that ask for personal or sensitive information.

4. What factors can affect insurance quotes?

Factors such as your age, location, driving record, health history, and the type of coverage you are looking for can all affect insurance quotes. Providing accurate information will help ensure you receive accurate quotes.

5. How can I save money on insurance premiums?

You can save money on insurance premiums by comparing quotes, bundling policies, increasing deductibles, and taking advantage of discounts offered by insurance providers.

Insurance quotes comparison