Tax Preparation Services: Everything You Need to Know

What Do You Mean by Tax Preparation Services?

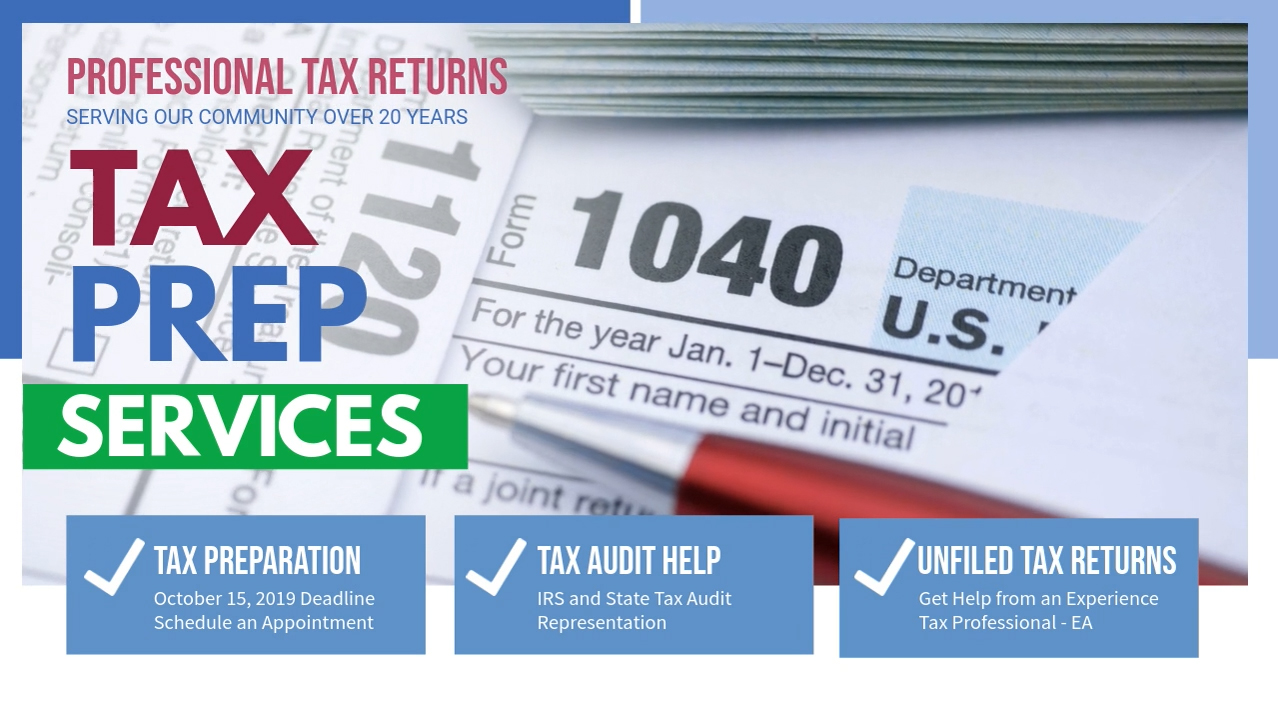

Tax preparation services refer to the professional help that individuals and businesses seek to accurately prepare and file their tax returns. These services are usually provided by tax experts such as accountants, tax preparers, and enrolled agents who have the necessary knowledge and experience to navigate the complex world of tax laws and regulations.

How Do Tax Preparation Services Work?

When you hire a tax preparation service, the first step is usually to gather all your financial documents, including income statements, receipts, and any other relevant paperwork. The tax preparer will then use this information to calculate your tax liability and identify any deductions or credits that you may be eligible for. Once the tax return is ready, the preparer will file it on your behalf either electronically or by mail.

What is Known about Tax Preparation Services?

Image Source: mendozaco.com

Tax preparation services are known for their ability to save individuals and businesses time and money by ensuring that their tax returns are accurate and filed on time. These services can also help you maximize your tax refunds by identifying all possible deductions and credits that you qualify for. Additionally, tax preparers can provide valuable advice on tax planning strategies to help you minimize your tax liability in the future.

Solution for Tax Preparation Services

If you are looking for a reliable tax preparation service, it is important to do your research and choose a reputable provider with a track record of excellence. Consider asking for recommendations from friends or colleagues, reading online reviews, and checking the credentials of the tax preparer. It is also a good idea to inquire about the fees and services offered to ensure that they align with your needs and budget.

Information about Tax Preparation Services

There are several types of tax preparation services available, ranging from large accounting firms to independent tax preparers. Some providers also offer additional services such as tax planning, audit support, and bookkeeping. It is important to clarify the scope of services offered before engaging a tax preparer to avoid any misunderstandings down the line.

Conclusion

In conclusion, tax preparation services play a crucial role in helping individuals and businesses navigate the complex world of taxation. By seeking professional help, you can ensure that your tax return is accurate, compliant with tax laws, and optimized for maximum tax savings. Remember to choose a reputable provider and communicate your needs clearly to make the most of your tax preparation experience.

FAQs (Frequently Asked Questions)

1. How much do tax preparation services typically cost?

The cost of tax preparation services can vary depending on the complexity of your tax return and the provider you choose. It is recommended to inquire about fees upfront to avoid any surprises.

2. What is the difference between a tax preparer and a tax advisor?

A tax preparer is someone who prepares and files tax returns on behalf of individuals and businesses, while a tax advisor provides strategic tax planning advice to help clients minimize their tax liability.

3. Is it necessary to hire a tax preparation service?

While it is not mandatory to hire a tax preparation service, doing so can help you avoid costly mistakes and ensure that your tax return is accurate and optimized for maximum tax savings.

4. How can I find a reputable tax preparation service?

You can find a reputable tax preparation service by asking for recommendations, reading online reviews, and checking the credentials of the tax preparer. It is also important to clarify the scope of services offered and inquire about fees upfront.

5. What are some common tax deductions and credits that I may qualify for?

Some common tax deductions and credits include the Earned Income Tax Credit, student loan interest deduction, and charitable contributions deduction. A tax preparer can help you identify all available tax breaks that you may be eligible for.

Tax preparation services